The concept is most commonly applied to inventory, but can also be used with fixed assets. This method can also be used to determine the average amount invested in each of a group of securities. Doing so avoids the larger amount of work required to track the cost of each individual security. Moreover, companies operating in international markets may find the average cost method appealing due to its compliance with both IFRS and GAAP. This allows for greater flexibility in financial reporting, especially for businesses with cross-border operations. It facilitates a uniform approach to inventory valuation that can simplify consolidation processes for multinational corporations.

Practical Tips for Optimizing Inventory Costs

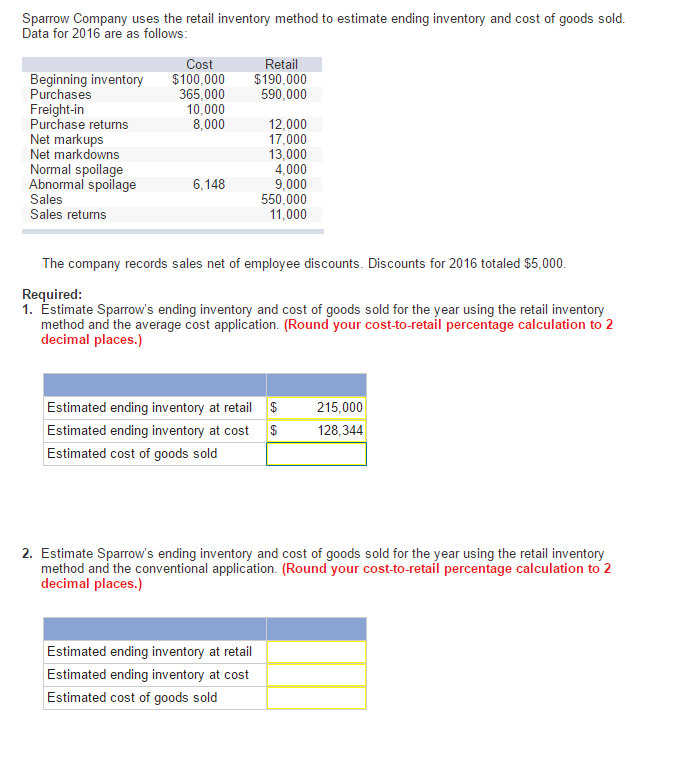

You can apply the same average cost to the number of things you sell during the previous accounting period and still determine the cost of goods sold. The company’s financial statements report the combined cost ofall items sold as an offset to the proceeds from those sales,producing the net number referred to as grossmargin (or gross profit). This is presented in the firstpart of the results of operations for the period on the multi-stepincome statement. The unsold inventory at period end is an asset tothe company and is therefore included in the company’s financialstatements, on the balance sheet, as shown in Figure 10.2. In a periodic inventory system, all inventory purchases are initially recorded in the Purchases account, which substitutes for the COGS expense during the period. At the end of the period, a physical inventory count is performed and the costs in the Purchases account are separated between units sold (COGS) and units on hand (inventory) based on the average cost per unit during the period.

Indirect Costs

This means that the cost of all 15 pairs is treated as if they were $11 each. You cannot use the Average Costing method in industries with items that are not similar. For instance, the electronics industry has a lot of devices with different parameters like model, size, color, and so on. Since these items are not identical, their prices will vary significantly. Since January 13 is our last transaction, let’s assume that no other transactions occurred during the month. Let’s foot the columns by adding the total costs under the Purchases and Cost of Goods Sold columns.

Data for Demonstration of the Four Basic Inventory Valuation

- Confusion may arise if work-in-process inventory costs incurred by the manufactured items yet to be completed are processed together with the material costs.

- You’ll see that the actual price at this time is $170 and yet the average cost is only $90.

- As a result, the earliest acquisitions would be theitems that remain in inventory at the end of the period.

- While the example above is a bit oversimplified, it illustrates the average cost method’s basic assumption.

- This culminates in the closure of inventory reported on the balance sheet as the cost of the earliest item that you purchased.

Should the number of your inventory items per batch be inconsistent, there will be a variation of costs assigned to each product. Cost accounting does not necessarily mean you have to make comparisons with other businesses. The idea is to make the information relating to your choices, especially with strategies.

You have a business, and just like many business owners, you want to improve your bottom line. You will need evaluation methods most common in eCommerce accounting to achieve your goal. In this post, you will understand what the account inventory cost method is and what it involves.

Periodic Weighted Average Cost Method

Multiplying the average cost per item by the final inventory count gives the company a figure for the cost of goods available for sale at that point. The same average cost is also applied to the number of items sold in the previous accounting period to determine the COGS. Under average costing method, the average cost of all similar items in the inventory is computed and used to assign cost to each unit sold. Like FIFO and how long should i keep records LIFO methods, this method can also be used in both perpetual inventory system and periodic inventory system. In the FIFO method, it is assumed that the first units of inventory purchased or produced are the first ones to be sold. As a result, the cost of goods sold (COGS) reflects the cost of the oldest inventory items in stock, while the ending inventory reflects the cost of the most recently acquired or produced items.

In perpetual inventory system, we have to calculate the weighted average cost per unit before each sale transaction. The weighted average cost method accounting is a method of inventory valuation used to determine the cost of goods sold and ending inventory. Weighted average accounting assumes that units are valued at a weighted average cost per unit and applies this calculated average to the units sold and the units held in ending inventory. The average cost method influences how financial statements are prepared and interpreted, particularly affecting the income statement and balance sheet. On the income statement, the cost of goods sold (COGS) is calculated using the average cost of inventory, smoothing out fluctuations in gross profit from volatile purchase prices.

The less inventory you keep on hand, the closer your average cost of inventory will be to the current price of inventory. You could also calculate the cost of sales by adding up the inventory issue costs in the second column of the ending inventory calculation, which would also give the same answer. Using the Average Cost Method, calculate the values of ending inventory, cost of sales, and gross profit at the end of the first week.