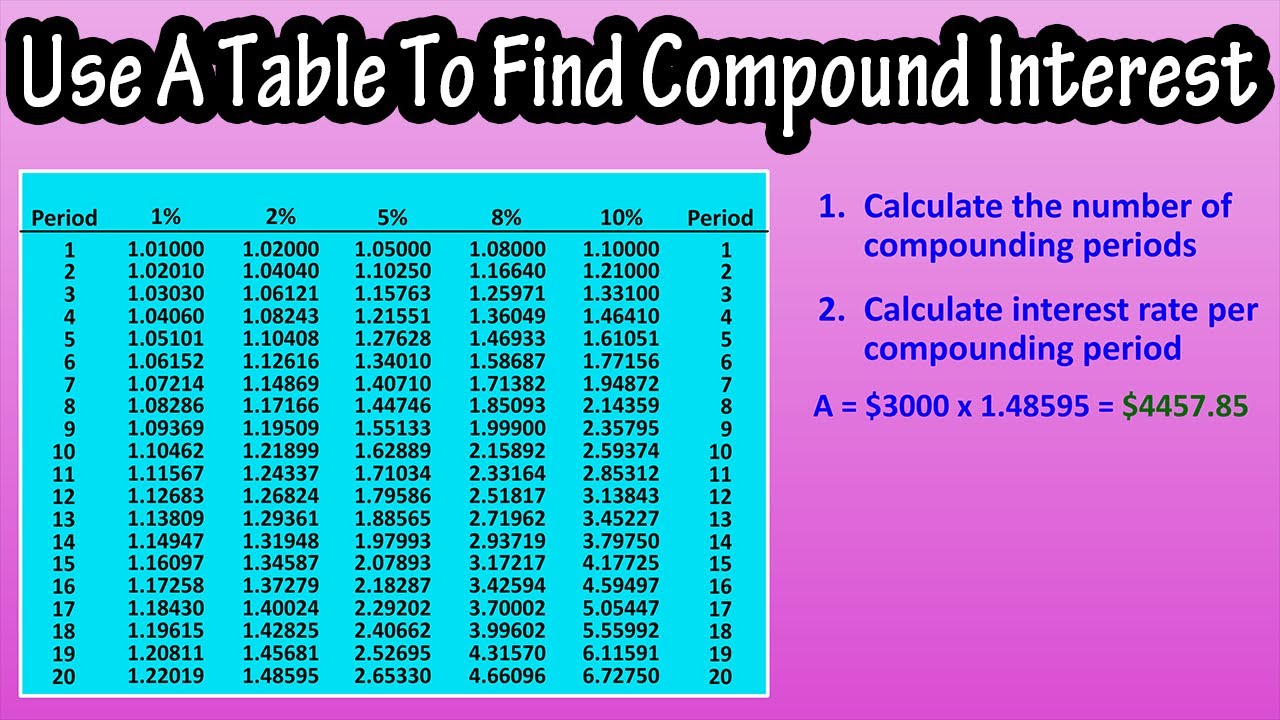

Calculate compound interest on an investment, 401K or savings account with annual, quarterly, daily or continuous compounding. This means that [latex]6\%[/latex] compounded quarterly is equal to a periodic interest rate of [latex]1.5\%[/latex] per quarter. Interest is converted to principal [latex]4[/latex] times throughout the year at the rate of [latex]1.5\%[/latex] each time. The critical difference is the placement of interest into the account. Under simple interest, you convert the interest to principal at the end of the transaction’s time frame.

Compounding frequency

- For example, Roman law condemned compound interest, and both Christian and Islamic texts described it as a sin.

- For longer-term savings, there are better places than savings accounts to store your money, including Roth or traditional IRAs and CDs.

- Much like a snowball at the top of a hill, compound interest grows your balances a small amount at first.

If you select “continuous” from the compounding dropdown in the calculator, it will yield the highest interest amount. Interest will be earned on contributions, leading to more exponential growth. This means that [latex]0.05\%[/latex] per day is equal to [latex]18.25\%[/latex] compounded daily.

Set Monthly or Annual Contributions

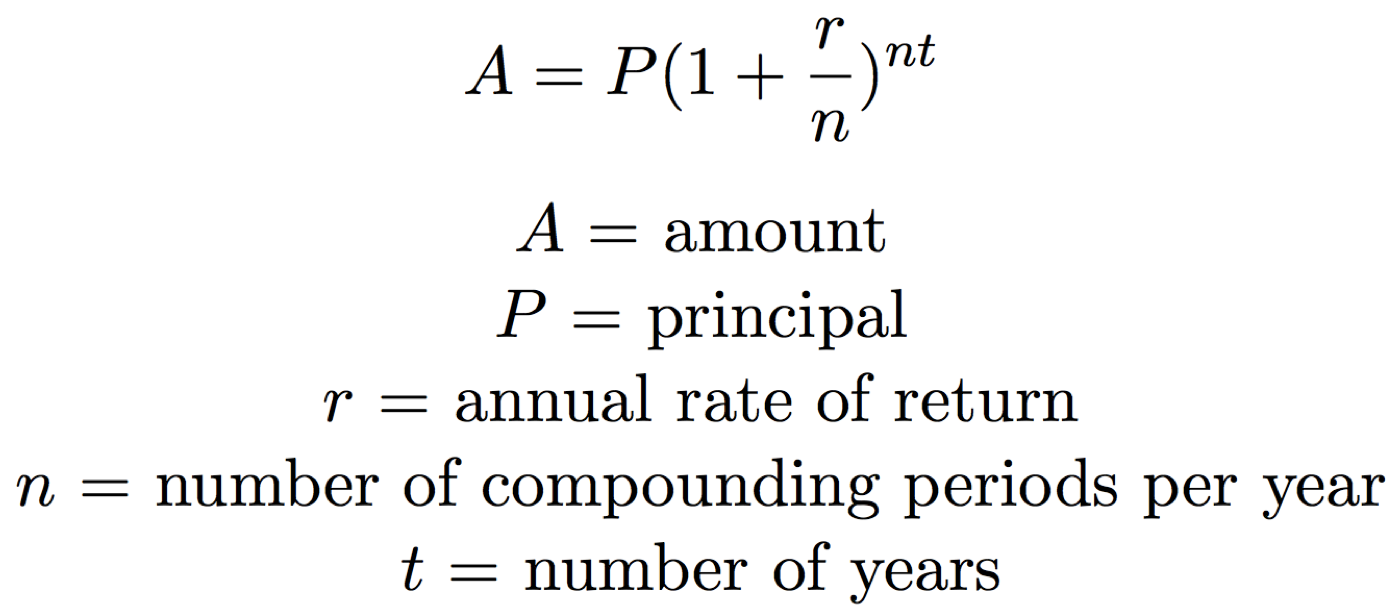

Compound interest involves interest being periodically converted to principal throughout a transaction, with the result that the interest itself also accumulates interest. This means that interest earned in the previous compounding period will earn interest in all subsequent compounding periods. The more frequently interest is compounded within a time period, the higher the interest will be earned on an original principal. The following is a graph showing just that, a $1,000 investment at various compounding frequencies earning 20% interest. MoneyGeek’s compound interest calculator calculates compound interest using the above formulas.

What’s the difference between simple and compound interest?

If you have any feedback or questionsabout the RoR or TWR, please contact us. It is for this reason that financial experts commonly suggest the risk management strategy of diversification. Number of Years to Grow – The number of years the investment will be held. Expectancy Wealth Planning will show you how to create a financial roadmap for the rest of your life and give you all of the tools you need to follow it. When it comes to retirement planning, there are only 4 paths you can choose.

Our flagship wealth planning course teaches you how to secure your financial future with certainty. The depreciation calculator enables you to use three different methods to estimate how fast the value of your asset decreases over time. While things get a bit more complicated when contributions are introduced, these are the steps needed to calculate compound interest. Interest can technically be compounded at any time interval you would like, but the time intervals above are most common.

How is compound interest calculated?

As you can see this time, the formula is not very simple and requires a lot of calculations. That’s why it’s worth testing our compound interest calculator, which solves the same equations in an instant, saving you time and effort. In this example you earned $1,000 out of the initial investment of $2,000 within the six years, meaning that your annual rate was equal to 6.9913%. Note that in the case where you make a deposit into a bank (e.g., put money in your savings account), you have, from a financial perspective, lent money to the bank. Calculate the future value of money using our compound interest calculator. Enter the present value, additional contributions (if any), interest rate, and length of time in years below.

Please refer to our Inflation Calculator for more detailed information about inflation. The interest rate of a loan or savings can be “fixed” or “floating.” Floating rate loans or savings are normally based on some reference rate, such as the U.S. Federal Reserve (Fed) funds rate or the LIBOR (London Interbank Offered Rate).

Start by multiply your initial balance by one plus the annual interest rate (expressed as a decimal) divided by the number of compounds per year. Next, raise the result to irs issued identification numbers explained the power of the number of compounds per year multiplied by the number of years. Subtract the initial balancefrom the result if you want to see only the interest earned.